Courtesy: First Southern National Bank Barring a few committed ones, we all struggle to save more towards our future expenses, vacation expenses, retirement savings, kids’ college tuitions and so on. Reasons cited by literature range anywhere from lack of self-control, … Read More

-

BlogFollow our blog for insightful analysis and expertise on development

BlogFollow our blog for insightful analysis and expertise on development

trends, policies and evidence.

Analyzing the BC Model (Part III) Why isn't it Working? – Asymmetry Between the Model and Agent/Client Needs

LEAD Research Team | November 1, 2012

In ourfirst post in this series, we discussed the key advantages of the BC model and the reasons that it should succeed as an apex financial inclusion tool. However, as we stated in our second post, the model has not been performing … Read More

Analyzing the BC Model (Part II) Why isn’t it Working? – Dormancy of No-Frills Accounts

LEAD Research Team | October 29, 2012

[Terminology Used: Agents or Customer Service Points (CSPs) – Individuals, shops or other outlet points responsible for direct contact with clients. They open bank accounts, check Know Your Customer (KYC) requirements, carry out money transfers and transactions and in some cases, extend … Read More

Analyzing the Business Correspondent Model (Part I) – Why BCs?

LEAD Research Team | October 25, 2012

Today, we begin a series on the Business Correspondent (BC) model based on findings from CMFs on-going studies and external research on the sector. For starters, what are the particular advantages of using information and communications technology (ICT) based correspondents … Read More

Treated Bednets – Dealing with Mosquitoes: Where is the Problem?

LEAD Research Team | October 24, 2012

Well, this week has been festive not just as per the Indian calendar alone, the weather in Madras has been rather pleasant with consistent rainfall. However, consistent rainfall in India does have its share of problems that it brings – … Read More

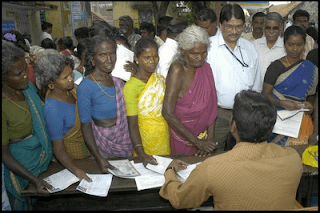

Hand in Hand- Profile of CMF's Partner Organisation

LEAD Research Team | October 19, 2012

The following blog intends to familiarize our readers with the kind of partner organisation, CMF works with. The references of these articles have been taken from the HiH annual report. Picture Courtesy: Hand in Hand website Hand in Hand … Read More

Remembering the Field

LEAD Research Team | October 18, 2012

Drawing by Samira Jain I have not taken any photos of any of my field experiences in Bihar, mostly due to an inexplicable sense of discomfort in taking photos of people and their surroundings (even when they’re not study respondents … Read More

Re-imagining Policy

LEAD Research Team | October 17, 2012

India’s public expenditure on agriculture is one of the highest in the Asian region; yet, agricultural productivity remains relatively low. The main policy instrument used for domestic agriculture seems to be focus on some form of a subsidy. More than … Read More

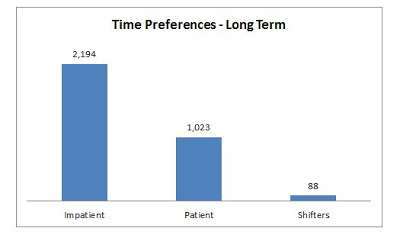

Tick Tock, Preference Shock

LEAD Research Team | October 16, 2012

The previous blog about the ongoing project in Satara, “Economics and Psychology of Long Term Savings and Pensions” was an introduction to why time-preference inconsistency is important and how it may manifest itself. The current blog will attempt to describe … Read More

What was the “Agricultural Debt Waiver and Debt Relief” Scheme About?

LEAD Research Team | October 12, 2012

Photo Credit: http://www.aegindia.org According to Malcolm Harper, “the loan waiver scheme is an expensive, populist device that won’t have much effect” (Eye on Microfinance, Volume 7). This was in response to the In March 2008 “Agricultural Debt Waiver and Debt Relief” … Read More

- « Previous Page

- 1

- …

- 19

- 20

- 21

- 22

- 23

- …

- 25

- Next Page »