| Courtesy: First Southern National Bank |

Barring a few committed ones, we all struggle to save more towards our future expenses, vacation expenses, retirement savings, kids’ college tuitions and so on. Reasons cited by literature range anywhere from lack of self-control, lack of attention, and time inconsistent preferences.

As Karlan, McConnell, Mullainathan and Zinman (2011) state, people are able to adequately predict savings needed for regular consumption, but usually forget or under-save for lumpy expenditures in future such as an unplanned concert ticket. This statement assumes that people have perfect knowledge about their future income, and people are more likely to forget about their future expenses than their future income – calling this behavior a lack of attention.

When people overlook such lumpy expenses, they over-consume today; and to meet future lumpy expenses, they either tend to forgo their regular expenses, or borrow. Though it may seem that such small lumpy expenditures do not matter in the large scheme of things, but the researchers purport that several instances of such lumpy expenditures compound over time and distort the savings regimen. Inattentive individuals pay attention to current consumption and current lumpy expenditure, and not to the future lumpy expenditure, therefore under-forecasting lumpy expenditures because:

- People are either unaware of their inattention;

- They overly optimistic about their ability to forecast;

- They are unable to provide themselves with reminders as third parties could;

- They either have to curtail the lumpy expenditure or consumption because the savings plan needs to be re-calibrated; and

- As in self-control models, inattentive individuals will under-save or over-borrow.

- Voluntary commitment savings devices such as 401k (in the United States) encourage savings.

- Default savings options have a large impact on retirements savings.

- Reminders address the lack of attention issue and help reduce forecasting failure; they do not address the lack of self-control issue, because those who lack self-control can still opt not to save despite the reminders. In particular:

- Reminders don’t need to be attached to a particular expenditure goal.However, reminders attached to a particular expenditure goal is more effective.3rd party Reminders work better than self-reminders for 1, 2.

- Mental accounting (keeping different real and imaginary accounts for different spending goals) provides strong association between today’s savings and specific future events, increasing the probability that people will attend to savings opportunities to smooth consumption.

- For a consumer with limited attention, an account label may increase the likelihood of attending to a future expenditure and optimally smoothing it.

- Therefore, savings rates should be higher when reminders mention a particular expense category.

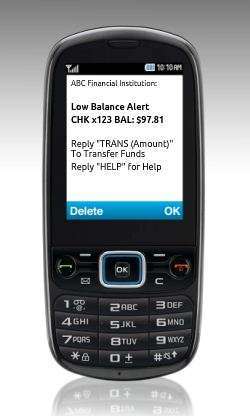

- In Philippines, people received a reminder text message and the messages were randomized to whether it’s a gain or loss language. Letter sent out as late reminder if deposit not made 3 days after schedule.

- In Peru, clients got annualized interest rate of 8% instead of 4% upon sticking to plan. 2 treatments were introduced: (1) Clients got letters with reminder of the goal in addition to boilerplate reminders; (2) Clients got a gift either during opening of the account, or a jigsaw puzzle after making a deposit in the account.

- In Bolivia, clients received a bonus interest rate of 6% for the first 10 months following enrollment in the program (compared to 3%), and free life and accident policy if they followed the deposit plan. Clients missing one deposit, withdrawing before payout date, forfeited high interest rate and policy was cancelled. Clients randomly assigned to reminder text message, no late messages were provided.

- Reminders increase savings – Clients who received reminders saved 6% more than those who did not, and were 3% more likely to save their targeted amount by their goal due date. Findings not significantly different across settings.

- Specific reminders are even more effective- Reminders that mentioned specific savings goal (in Peru example only) increased savings by 16% relative to no reminder, while reminders that had no specific expenditure mentioned had no effect.

- Assumption about mental labeling needs more research – Mental labeling which was done in Peru had no significant effect on savings – Control was given pen on opening account, and treatment was given a picture of the savings goal during account opening or a puzzle of the savings goal after deposit. Neither had an effect, especially when compared to expenditure related reminders.

- Reminders about financial incentives also works – In Bolivia, those who received reminders that the account contained a financial incentive (year-end payout) increased savings, compared to those who didn’t receive this reminder.

- Text messages are effective – Low-cost text messages are cost-effective, and were continued in Bolivia after the study.