In the first part of this series, we highlighted gender gaps in access to mobile financial services and their usage among women in Bangladesh. In this article, we take a look at assisted models of digital finance such as over-the-counter transactions, and the reasons why they may be here to stay in the near future.

“Banking is more fundamental than I realised. There have been attempts: the microfinance groups, co-operatives, but the transaction fees have always been too high. Until we get those services down with very low fees onto the cellphone in digital mode then banking will always be for those who are better off”.

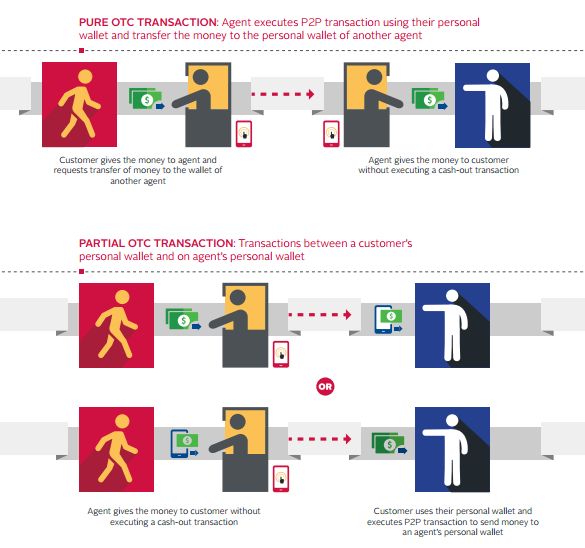

“In Bangladesh, over-the-counter (OTC) transactions usually h

appen as a person-to-person transfer arranged between a sender and receiver. The sender and receiver each use an agent to complete the electronic transaction. The two agents involved can make these transactions happen in a variety of technical combinations (most often as cash-in transfer of value to an account or a cash-out from an account).”

1. Mobile Financial Services in Bangladesh, April 2015 https://www.microlinks.org/library/mobile-financial-services-bangladesh-survey-current-services-regulations-and-usage

-select-us