In the second phase of the intervention, 60% of the treatment households from the first phase were randomly assigned to get spot and future prices of crops directly on their mobile phones via text and voice message. The study found that 44% of the respondents in our sample who receive price information on their mobile phones said that text messages were the most important source of spot price information. While 30% of the respondents in our sample who received price information on their mobile phones quoted text messages as being the most important source of futures price information. On the other hand, of the households that do not receive price information through village boards or mobile phones, more than half primarily rely on newspapers and peer farmers as information sources. In spite of the availability of futures prices in newspapers only 20% of farmers in this group report this as the primary source of information.

Newsletter Article – Futures Price Information for Small and Medium Farmers

By Samik Adhikari, Gautam Bastian, Lisa Nestor

Agriculture and allied activities continue to employ 52% of the Indian workforce and account for 17.2% of GDP. Average land holding size however remains very low, with 70% of the land held by farmers who own 2.47 acres (1 hectare) or less. As a result most farmers do not benefit from economies of scale, enjoying limited profitability even in the best of times. They are also particularly vulnerable to fluctuations in harvest time output prices. Even a 10% swing in prices can make the difference between stable consumption and food insecurity. The recent development of agricultural futures markets in India holds the promise of providing farmers with a tool to manage price fluctuation risk.

However, most farmers cannot directly participate in futures markets because of minimum quantity thresholds needed to make trades on the exchanges. Future exchanges may nevertheless offer important benefits to all farmers. In particular the availability of futures price information can help farmers form accurate price expectations and make informed agricultural decisions about planting, crop-mix, harvest scheduling as well as sale timing and location.

Another potential channel through which spot and futures prices could help farmers increase their bargaining power in price negotiations with local traders and middlemen. Many small-scale farmers sell their produce to village traders saving the cost of transporting the harvest to the district market. However, if farmers lack accurate market price knowledge, the intermediaries may underpay for the farmers output preventing them from fully realizing their potential income. Accurate market price information can even help farmers who choose to sell district markets select which markets to sell at.

Design and Results

Centre for Micro Finance collaborated with Prof. Shawn Cole from Harvard Business School and Prof. David Yanagizawa-Drott from Harvard Kennedy School, and implementation partner Self Employed Women’s Association (SEWA) to initiate a rigorous evaluation of farmer’s access to futures price information in April 2007. Drawing on SEWA’s established network, 108 villages were identified in Ahmedabad, Surendranagar, Mehsana, and Vadodara districts in Gujarat, India. Ten households were chosen from each of the 108 villages to be surveyed on a semi-annual basis from 2007 to 2012. The survey data captured important household characteristics as well as price knowledge and expectations, the household’s level of trust in financial markets and data on investment and agricultural decisions.

In the first phase, half the villages were ‘treated’ with regular price updates using village boards, and the other half were the ‘control’. Household data collected from 2007 to 2011 shows that households in the treatment villages are 38.3% more likely to know what a futures market is in comparison to the control group. This finding is corroborated by the results of a test measuring knowledge of futures markets in which households receiving spot and futures price information are likely to score 23.7% higher than those households that do not receive price information. The study also found that farmers receiving price information are 11.1% more likely to be willing to trade in the futures market and 7.3% more likely to say that farming decisions are riskier without observing futures prices when compared to control households.

Perhaps the most encouraging finding in the usage of the treatment implies that participants trust the prices displayed on village boards, as well as spend less time and money on travelling to the market to access price information. Households in villages with village boards were 11.1% less likely to travel outside their village to obtain spot price information. They are also 13.5 % less likely to travel outside their village to obtain futures price information. As travel costs in rural India are high, the savings from the reduction in travel are an added benefit, which might justify scaling up this intervention.

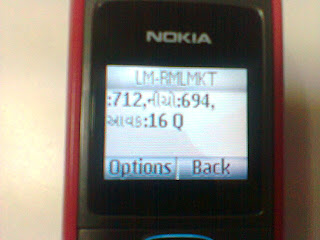

In the second phase of the intervention, 60% of the treatment households from the first phase were randomly assigned to get spot and future prices of crops directly on their mobile phones via text and voice message. The study found that 44% of the respondents in our sample who receive price information on their mobile phones said that text messages were the most important source of spot price information. While 30% of the respondents in our sample who received price information on their mobile phones quoted text messages as being the most important source of futures price information. On the other hand, of the households that do not receive price information through village boards or mobile phones, more than half primarily rely on newspapers and peer farmers as information sources. In spite of the availability of futures prices in newspapers only 20% of farmers in this group report this as the primary source of information.

Significantly, the provision of SMS price information also improved farmers’ ability to forecast prices. We queried farmers about expectations of prices 1-2 months in the future. Respondents who received no SMS price information correctly predicted the future price of a crop (within 10% of the actual price) only 35% of the time. In contrast, respondents who received spot price information were within 10% of the realized price on average 46% of the time, and respondents who received spot and futures prices 47% of the time.

Policy Implications

Providing spot and futures price information to farmers changes their knowledge and perception of financial markets in general and futures markets in particular, and makes them more willing to trust and participate in financial markets. However this study does not find any evidence of impact on harvesting, storage and selling decisions or on the prices farmers received at harvest-time sales.

Village boards, text and voice messages have all been very popular with farmers. The use of mobile technology makes this an easily scalable intervention, since the cost of sending text messages is less than a rupee per farmer (approximately USD 0.02). Using a village board style intervention, local village leaders could be sent crop prices every day making them local resource persons who update village boards and are also able to answer farmer’s questions about the latest prices.